[Daily Pick] 전기차 배터리의 재사용(2nd Life)

[source] https://www.idtechex.com/en/research-report/second-life-electric-vehicle-batteries-2023-2033/924

IDTechEx는 세컨드라이프 EV 배터리 시장 규모가 2033년에는 70억 달러에 이를 것으로 전망한다.

배터리의 SOH(State of Health) 및 잔류 용량에 따라, 이차 전지는 정지 에너지 저장 및 저전력 전기 이동성 애플리케이션과 같은 덜 까다로운 애플리케이션에 추가로 활용될 수 있다. 이는 EV/배터리 제조업체, EV 고객, 전력회사, 그리드 운영자, 에너지 회사 및 전기 소비자를 포함한 부문 간 이해관계자에게 가치를 제공한다.

향후 10년 전기차 배터리의 재사용(2nd life) 방향성 주목

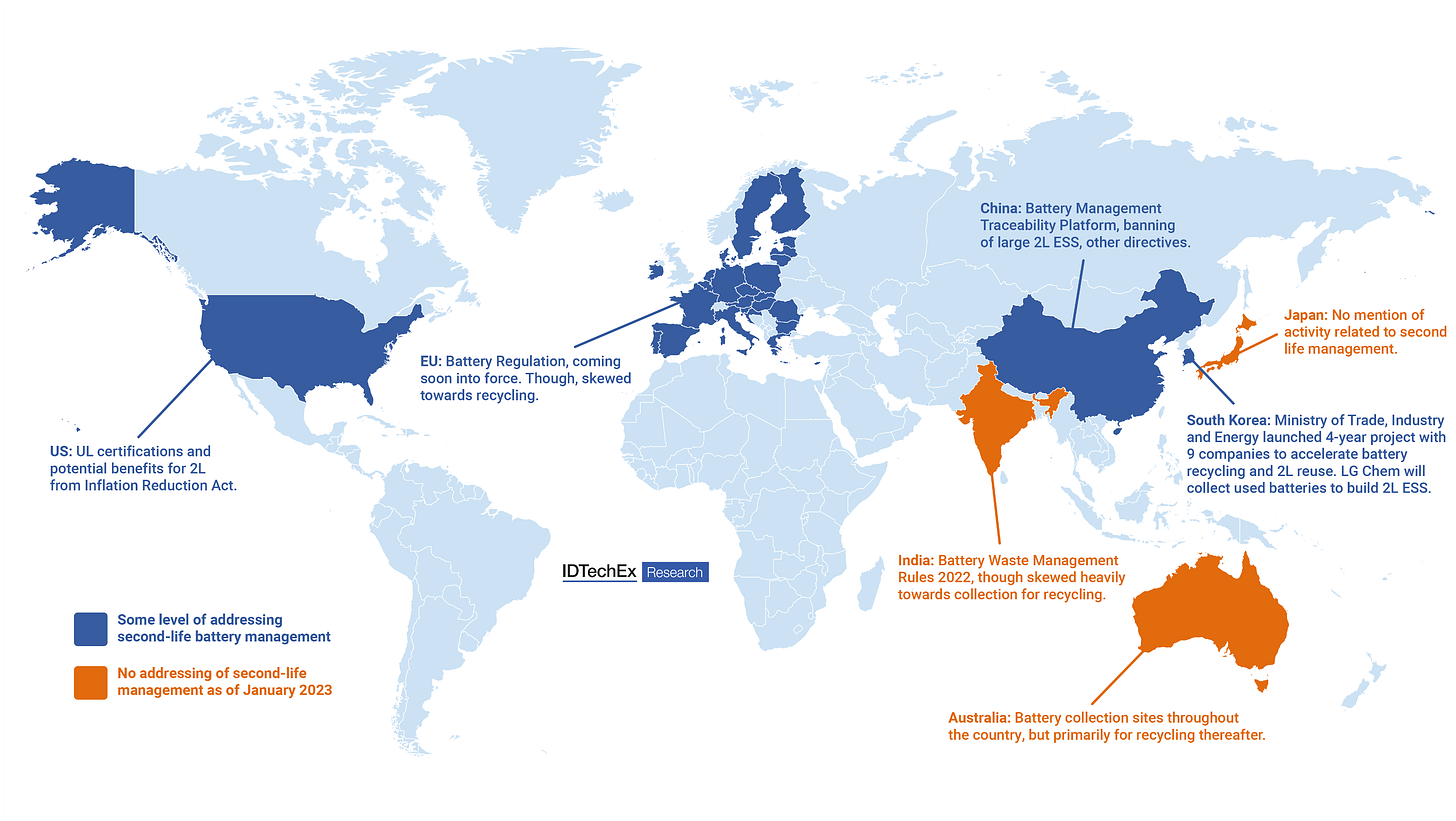

중국은 기지국 백업 전원(base station backup energy) 납축전지 대체

미국과 유럽은 전력망(grid) 신재생 발전과 FTM(Front-of-the-Meter) ESS

The Second-Life EV Battery Market to Reach US$7B by 2033

The second-life EV battery market is one of great importance for many reasons. These include adding value to future energy infrastructure, creating a circular economy for electric vehicle (EV) batteries, and providing a lower levelized cost of storage compared to new batteries. The new IDTechEx report, "Second-life Electric Vehicle Batteries 2023-2033", highlights advancements in the second-life industry, ranging from regulatory and technology developments to player activity in battery diagnostics and repurposing. IDTechEx forecasts that the second-life EV battery market will reach US$7B in value by 2033.

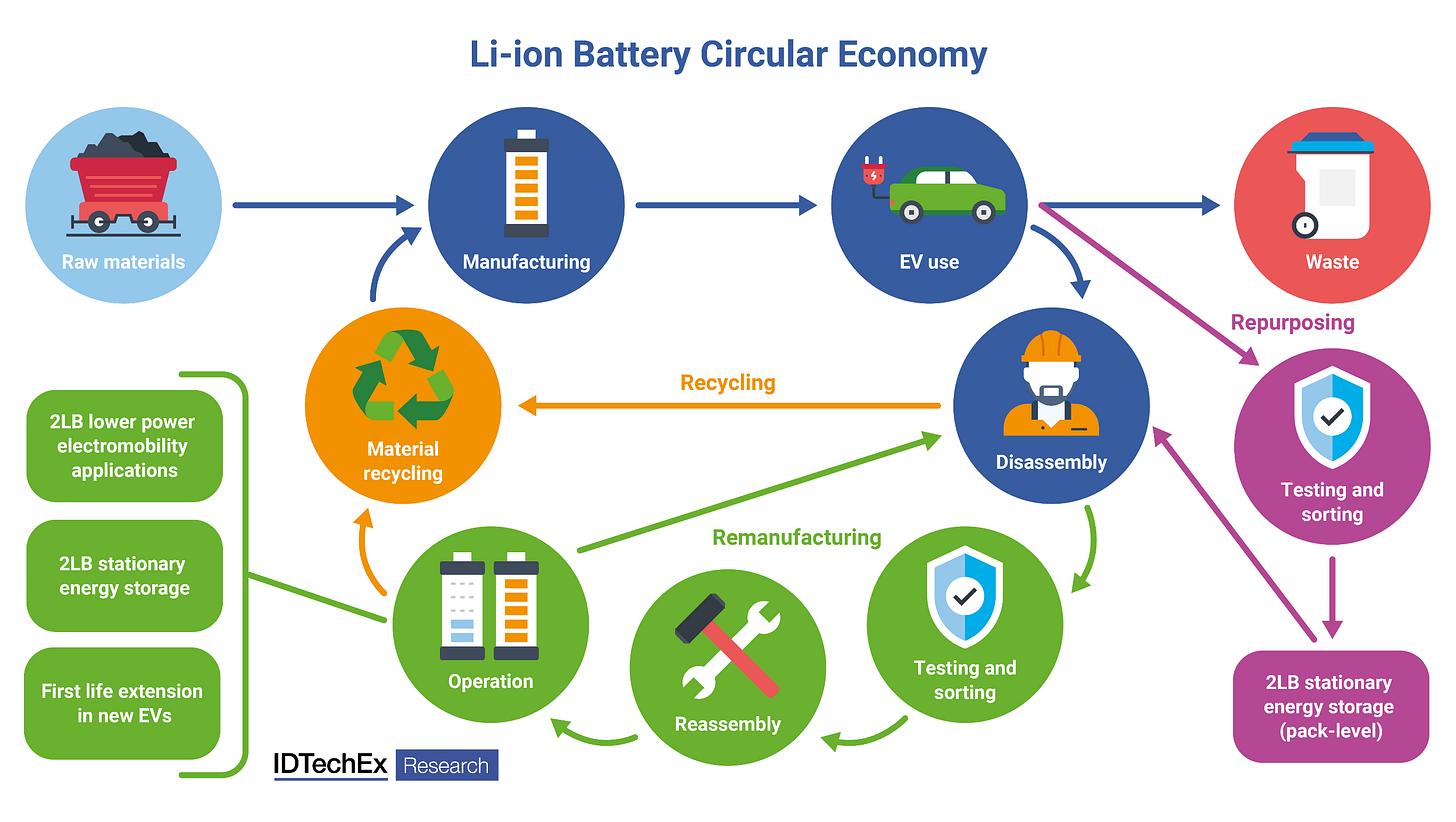

The bulk of EVs currently use Li-ion battery chemistries, and once their eight-to-ten-year initial lifetime has expired, they are usually unsuitable for future EV use. Battery second use (B2U) extends the lifetime of the EV battery. Depending on the State of Health (SOH) and residual capacity of the battery, second-life batteries can be further utilized in less demanding applications, such as stationary energy storage and lower-power electromobility applications. This brings value to cross-sector stakeholders, including EV/battery manufacturers, EV customers, utilities, grid operators, energy companies, and electricity consumers.

Stakeholders must make key decisions regarding the End-of-Life management of retired EV batteries. Second-life batteries created through a remanufacturing process offer benefits of maximizing battery value and extending battery life, whereas recycling results in batteries losing this value prematurely. If remanufacturing is chosen, second-life BESS developers must make further decisions to ensure that the creation of their second-life systems is techno-economically feasible. Remanufacturers must consider several process operations, such as battery procurement, depth of disassembly, testing/grading, and reassembly procedures. The new report from IDTechEx assesses how these processes impact the final pricing of second-life BESS to be competitive with new Li-ion BESS.